1/2020 Virus-infected markets

Open pdfVIRUS-INFECTED MARKETS

I wrote the original version of this letter to shareholders in mid-February, and its topic was risk. I had been carrying this rather general theme around in my head for some time and decided to use it because nothing really very interesting was happening in the markets. It is difficult to believe today, but none of the main issues that the stock markets are facing today were even on the table back then. Bank of America’s regular Global Fund Manager Survey showed at that time that the main source of risk to investors was the November presidential election in the United States.

The proverbial ink on my letter was scarcely dry, however, when time accelerated and big things started to happen in the markets. So, I threw away the original version of the letter and wrote a new one dedicated to current events in the markets. I admit that it is longer than usual, but I have aimed to make it as concrete as possible. To a certain extent, it also sums up the webinar we had last week.

In mid-February we knew that there was a new virus going around in China. At the same time, though, we also knew this to be the 12th global epidemiological threat in the past 20 years. Some of the previous ones also had had their origins in China, but their impacts on peoples’ health in other countries and also their effects on stock markets had been minimal. This time, however, the virus has spread across the whole world and so even the stock market indices were hit.

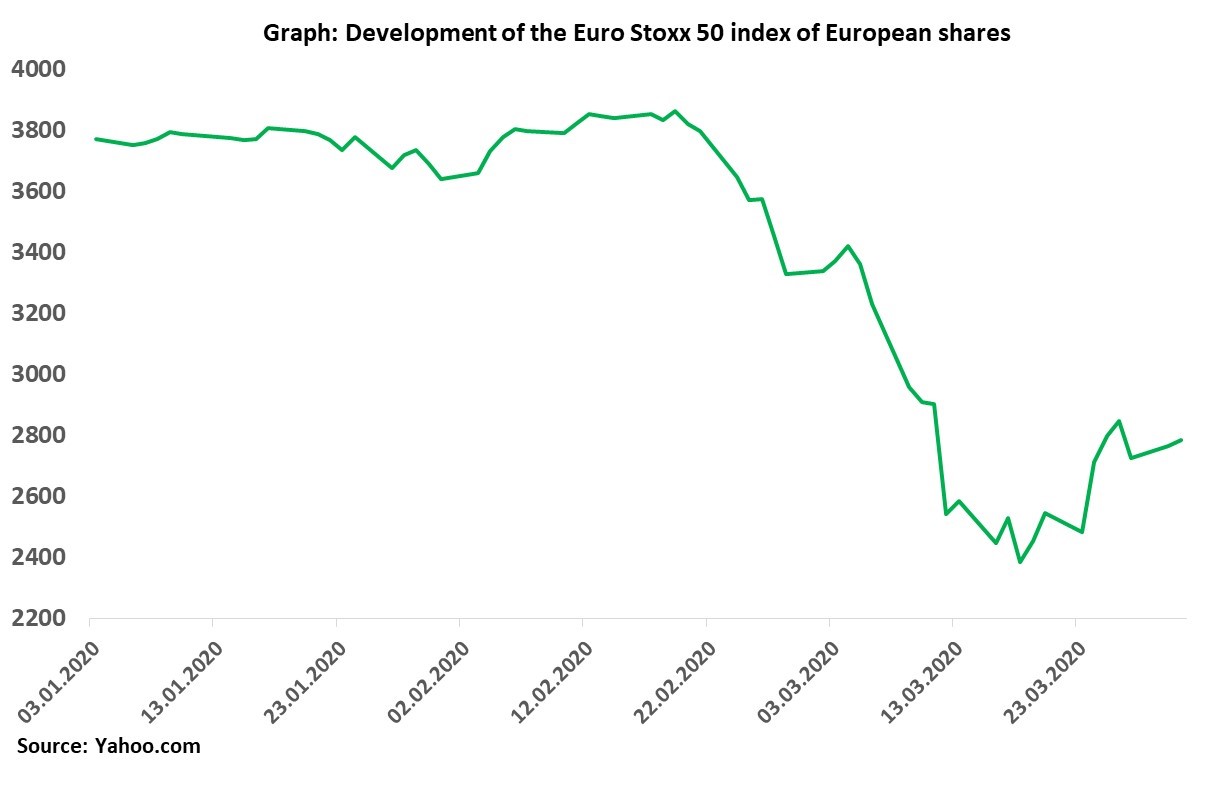

The markets fell by 30–40% in the course of a single month, and for some of the main markets it was the largest one-month drop in their histories. Interesting is that in the country of origin, China, share prices fell by only about 12%. In the hardest hit European country, Italy, the decrease was about 42%, and that is about the same as in Korea, where the virus developed only mildly. Japanese stock prices fell similarly as did those in the United States, which means by about one third. At the same time, the virus did not spread much in Japan whereas in the USA it is just picking up full speed.

To say that this development took investors by surprise all across the world is probably an understatement. Equally surprised is the general public and above all the managers of companies. Today they need to reshuffle their priorities and solve problems they had not even dreamt of a few weeks ago. Two things will decide the success or failure of individual companies. The first is how the management will adjust to the new situation, and the second is how much room to manoeuvre they have. The second of these seems crucial to me.

Stock market developments are being driven today by five key influences. These are: the virus, the oil price, interest rates, the reduced availability of credit and debt financing, and the support of states and central banks. The first two influences are of foremost importance. They have independent origins of their own. The next two are secondary and induced by the first two. The final influence is then a reaction to current developments. Looking to history, we have no precedent for the first one. Concerning the others, we do have and so we can better work with them.

The virus

We can see the influence of the epidemic everywhere around us. A substantial part of the economy has been idled. Nobody knows right now how great will be its decline in performance, but for countries in general lockdown it surely will be tens of percentage points through its duration. Maybe 10%, 20%, 30%, even more? It is hard to say. But it will be really a lot. As soon as the economic statistics capturing the impacts of the restrictions begin to appear, the numbers will be so bad that it will seem at first sight that they must be mistaken. Most crucial will be how long this situation will endure.

I like to use sport analogies, so here is another one. If a top-performing athlete stops training for a week, he can jump right back into his original training plan again. If he stops training for a month, he needs to adjust that plan and back up a bit back in his preparation. If he stops training for three months, he can write off most of the season. It will be similar in restarting the economy. The longer the shutdown the worse will be the restart, because quite a few companies and businesses will not open up again and the jump up in unemployment will reverse itself only gradually.

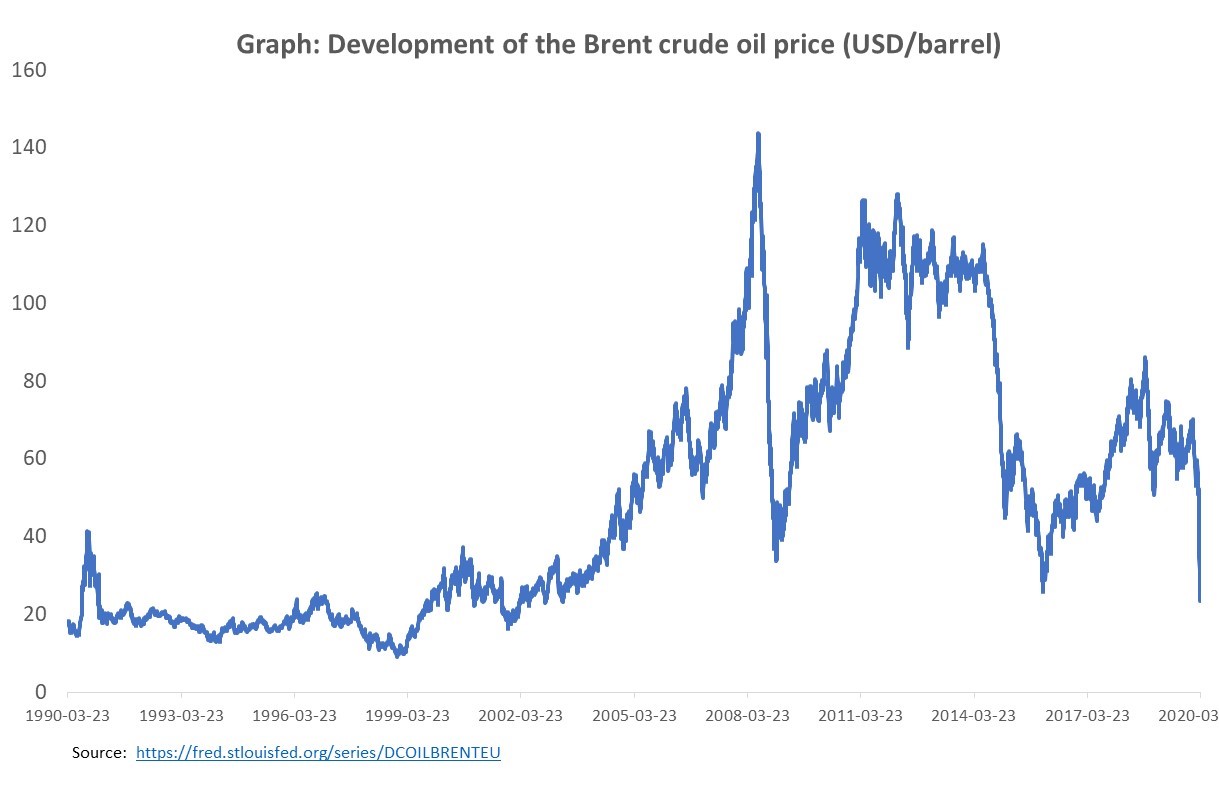

Oil price

The oil market crash occurred rather in the shadow of the virus pandemic. At the beginning of the year there had been a modest surplus in the markets as production had somewhat exceeded demand. Nevertheless, within OPEC as well as together with Russia, no agreement could be reached to reduce production. On the contrary, they brazenly are competing with one another over who can longer withstand the low prices. Saudi Arabia decided even to boost production. Because demand will temporarily fall due to the coming recession, the oil surplus in markets will be even greater than it is today. We expect the daily consumption of 101 million barrels may diminish by 15–20% for two months. This would mean there will be about 1 billion barrels of excess crude oil. That is such an enormous amount that there is no place where it could be stored and producers will be willing to sell it practically at any price.

So in the short term the price of crude oil will remain very low. Gradually, however, demand will return to its normal level and, most importantly, production will go down. At today’s oil prices, it does not pay for almost anybody to invest into new extraction capacities. Without the required investments, production volume will gradually decline. Because crude yields from existing capacities diminish by around 5% a year, this means that each year it is necessary to put into operation new extraction capacities of about 5 million barrels a day. Nobody will rush to do this now. Oil exploration companies already have announced massive cuts in new investments and a switch into survival mode.

Investments into new extraction will be undertaken only when the price of oil will be high enough not only to cover extraction costs but also to provide sufficient returns on the capital invested. The time response on the supply side is slow but sure. The oil price will gradually rise to a level at which demand and supply will be in balance. In our opinion, this is higher than USD 50 dollars. It might be much higher.

Why is this important? A drop in oil production and slashing of big investments will cause activity to slump in several others sectors. These will include also the energy industry’s services and supply sectors, capital and investment goods sectors, and some parts of manufacturing sectors and transportation. We have a precedent for this whole situation from the time period after 2008 and after 2015. Now, we can expect to see a replay.

Interest rates

One of the first reactions to the virus epidemic on the part of central banks was to cut interest rates. In Japan and the EU there was not much enthusiasm for this, because even though central bankers know that negative interest rates can theoretically be lowered even further the effect of doing so is very questionable. The most significant cut in interest rates occurred in the United States. Low rates have effects on all economic entities – positive for some, negative for others – and the overall long-term effect of rates around zero remains unclear. One sector that will be harmed substantially by the unexpected and sharp drop in rates is that of American banks, because it will narrow their net interest margins and profits. American banks have a large representation in stock market indices, and decline in their share prices contributed significantly to the indices’ overall decline. We expect that the environment of very low interest rates will be around for a very long time.

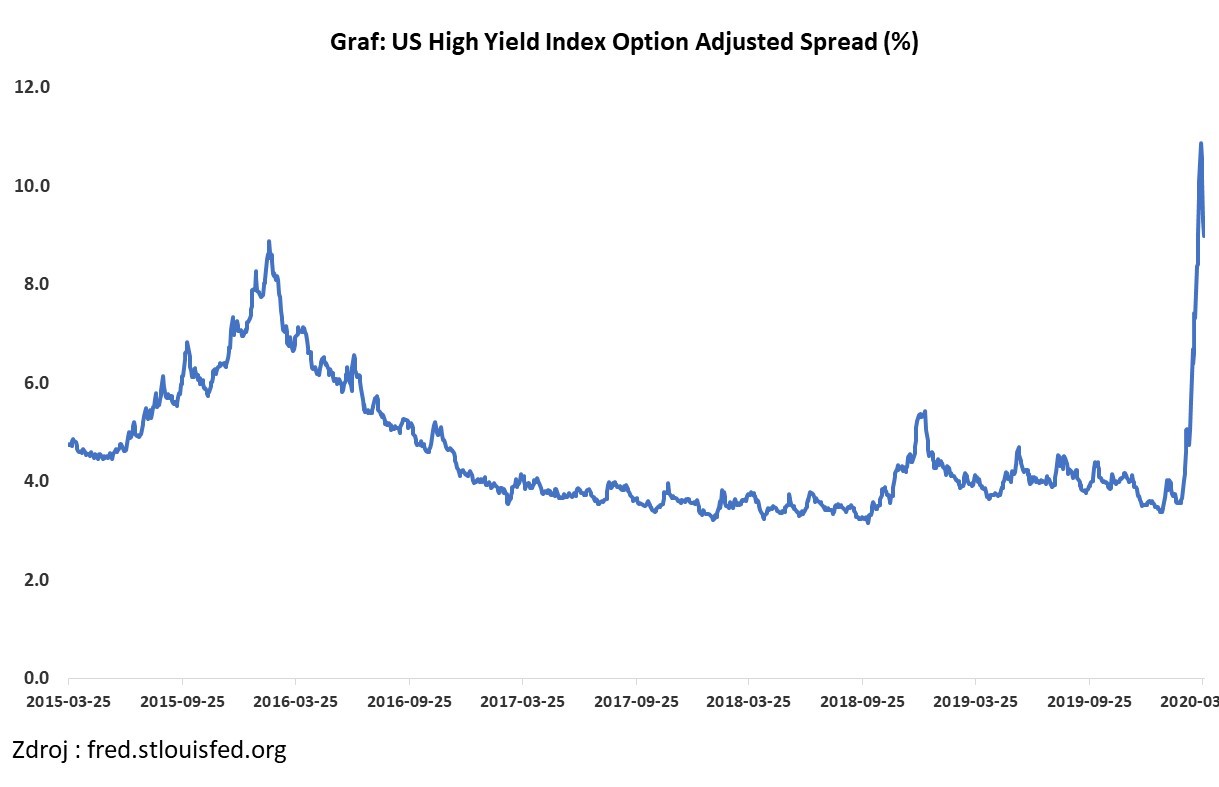

Credit and debt financing

Anytime the economy’s wheels seize up in recession, the key role played by debt becomes immediately apparent. Debt is at one and the same time both a burden and a solution. Some companies are completely at a standstill today, some partially so, and some, although running at full speed, will do more poorly for some time. Worsened cash flow will bring greater debt financing requirements from companies, and demand for money will rise dramatically. Its supply, however, is not unlimited and the price of debt financing will reflect the much-increased risk. This can best be seen in the following graph, which shows how much the costs of financing for companies without investment-grade ratings increased literally overnight. If available at all, it is prohibitively expensive.

When we add in the enormous budget impacts in individual countries that will need to be financed, it is no wonder that an acute liquidity shortage exists in markets, and most especially of dollars, because this is the main global reserve currency.

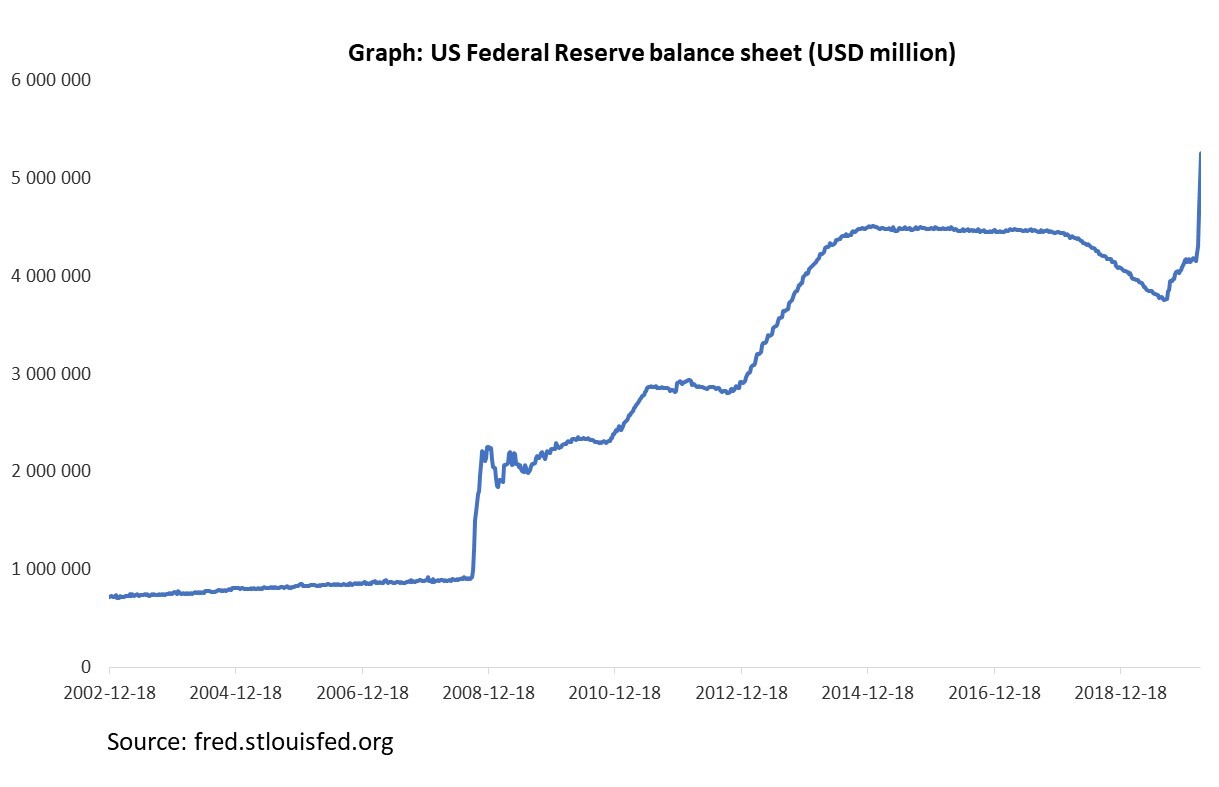

Support of states and central banks

This situation has only one solution, and that is vast budget support accompanied by massive purchases of bonds (or of other assets, as the case may be) by central banks. If you read my posts on Vltava Fund’s Facebook profile, you may have noticed a text from mid-February entitled “In no sense is this QE!” The title was intentionally ironic. The article explained that the resumption last year in September of massive treasury bond purchases by the American central bank was caused by a lack of other buyers and that the Fed would remain the main buyer also in future. This is doubly true today, when the US federal budget deficit may easily jump this year from USD 1 trillion to perhaps USD 3 trillion. The market cannot absorb such sums, and the Fed’s balance sheet is already starting to show this. I would not be surprised if it swells to USD 7–8 trillion by the end of the year. We have here QEi – Quantitative Easing to Infinity.

Other countries are in similar circumstances. We were in a comparable situation regarding credit and debt financing in 2008. At that time, it took several months before central banks and governments discovered what they needed to do. Today, they are able to react instantaneously and they are doing just that. On Monday, 23 March, the US central bank announced that it will be purchasing unlimited quantities of financial assets and at the same time it broadened their spectrum. In the shower the next morning, I realized that when someday we will be looking at today’s events in hindsight, this moment will probably show itself to be the crucial turning point (see my post on Facebook entitled “The helm is turning” [Kormidlo se otáčí] from 24 March).

It is clear to me that economists will argue about long-term impacts of these measures, but the fact is that this is the only possible and effective tool available that will prevent a chain of existential problems between companies, banks and households. We have been living for some time already in an environment of so-called “helicopter money”. In terms of our investing, it matters not at all what we think about this. Our view is wholly agnostic. We accept it as a fact and invest accordingly.

Expected impacts

Based on what is described above, we expect a sharp but rather short recession followed by a recovery that is nearly as sharp and supported by unprecedentedly large measures taken by states and central banks and satisfaction of accumulated demand. It is altogether possible that later the economies may even become overheated.

A certain indication of how things could develop can be seen in the development in China. There, the virus appeared in November and the country was to a considerable extent in quarantine during January and February. Through the course of those two months, automobile sales dropped by 90%. Those sales came back to 60% of normal in March, and it is expected that in April they will return nearly to normal. Apple and Starbucks shops, which remain closed in the West, are already open again in China. The Chinese economy as a whole is picking up speed again.

Furthermore, we expect depression in some sectors. It is clear that not all sectors will suffer the same under the recession that is underway, and it is also likely that not all will return to their original levels. Cruise ships, travel agencies, hotel chains, airlines, the oil industry, parts of the financial sector, restaurants, sport betting, shared services and some other sectors are, and for some time will remain, in serious depression, and it is possible that even in a longer term they will suffer due to changed consumer behaviour.

We also expect existential problems for some companies. We use three tests to evaluate the financial resilience of companies. The first is the cash flow test. This means that a company must generate sufficient cash flow to cover its obligations. The second is the balance sheet test. This means that a company must have enough liquid assets to cover its liabilities. We apply this test mainly to financial companies. The third test is that of access to external financing. The worst result will fall to those companies that have never passed the first and second tests and had been relying on the market always to be ready to finance them. This condition may be unreachable for many companies now, and this may become decisive as the cash flow of practically all companies worsens. This is true across all sectors, countries, ownership types, and also for companies of various sizes.

Portfolio management today

Let us now turn our attention to our portfolio and to how portfolio management should look today. I will start with an example from the micro-world. If I were to visit the Olympia shopping centre here in Brno, I probably would find all the shops closed. Were I to bet which ones will do best in future, I would not be concerned with range of products, service level or prices. In the first place, I would be interested which of these shops will open again after this crisis. Probably not all. At present, this also is the key criterion in the macro-world, which means in the world of publicly traded companies. We are interested in those which not only will survive and will not be crippled in the long term but which may even emerge from the crisis stronger due to the fact that some of their competitors will fall away in the meantime.

That some stock prices should be 50%, 100% or in some cases even 200% higher than they are is almost certainly true, and it is very probable that after some time they will be. In order to benefit from this, we should be sure above all that these companies not only will survive but also will further prosper. This is what we are most concentrated upon at the time being. Under normal circumstances, we are looking for companies with some competitive advantage. Today we are interested in another kind of advantage – of the Darwinian variety. Investors are not overly interested in fundamentals at the moment. Emotions and transactions motivated by need for liquidity predominate. The attention will return to fundamentals only once we will be on the other side of the virus-infected valley.

Financial strength and resilience of our companies

First of all, it can be said that in our portfolio we have nothing that is on the front lines. We have no tourism, airlines, hotels, oil industry nor its closest suppliers, restaurants, capital and investment goods, American banks, and the like. Nor do we have any company that would need to rely on external financing from the market. All of our companies are long term profitable and we expect them to remain so. Moreover, they are financially strong. I divided them into four groups:

In the first group, there are companies holding large sums of net cash. These include Berkshire Hathaway (USD 125 billion in net cash), Samsung (USD 70 billion) and BMW (EUR 17 billion). Together, they make up 31% of the portfolio. Berkshire Hathaway itself comprises 17% of this, and if there is a company that survives absolutely anything it is this one. It is sort of the Keith Richards of the corporate world.

The second group is made up of the financial companies Sberbank, Markel and Credit Acceptance. Sberbank has owners’ equity of USD 70 billion, and last year’s net earnings were USD 14 billion. Its Tier 1 capital ratio is on the level of the best American banks JP Morgan and Bank of America even as its leverage of 6.6 is far lower. In the market where it operates, Sberbank has the strongest market position of all the world’s big banks.

Markel is an insurance company. Companies of this type have liabilities that ensue from damages paid out in the future. These are often spread across several decades. They have no capital outlays and they do not work with large amounts of debt. Specifically, Markel has debt of USD 3.9 billion with maturity as long as 30 years and liquid assets of USD 22 billion.

Credit Acceptance is a specialty finance company financing itself in the manner common for such companies. Its ratio of owners’ equity to total assets is 30%, which is a high value for this sector and that limits its need to work with debt. At present, the company has more capital than it is able to use effectively in its business, as evidenced by the fact that in December and February it repaid early bonds that were due in 2021 and 2023.

Also belonging to this group are S&U and Burford, but these positions are small and have no material impact. Together, this group makes up 22% of the portfolio.

The third group consists of companies with low indebtedness. These are Alimentation Couche-Tard (net debt to EBITDA 1.5), Babcock International (1.4), Crest Nicholson (−0.3), Magna International (0.7) and WH Smith (0.9). This group makes up 26% of the portfolio.

The fourth group includes just two companies that have larger debt levels than do the other companies we own, but their debts are nevertheless not particularly large in comparison to the market and the sectors within which they operate. These companies are LabCorp (2.8) and Teekay LNG Partners (6). We will return to LabCorp below. Although Teekay LNG Partners’ debt may seem high, closer examination shows it to be acceptable. This company owns 48 LNG tankers for transporting liquefied natural gas. Some of its contracts are for periods as long as 25 years, which is the lifetime of these ships. The average length of a contract is 15 years. Teekay has no investment projects that would require financing. The main issue that management is dealing with is whether the large cash flows that these ships produce should be used to repay the debt more quickly, to aggressively buy back its own shares, or to announce a preferred stock tender. These two companies constitute 13% of the portfolio.

To reach 100% percent, we still need to count our shares in the Japanese Nikkei 225 index.

Impact of the recession on business operations of companies in the Vltava Fund portfolio

I once again divided the companies into four groups: The first group consists of companies that can benefit from the recession. These are Berkshire Hathaway, Credit Acceptance and Markel, and together they make up 29% of the portfolio. All three benefited from the recession in 2008, and it is possible that they will benefit also from the current one.

As I have already mentioned, Berkshire holds USD 125 billion in cash. Not very long ago, Buffett was criticized for this by some people. It was cited as evidence of his alleged inability to invest money. Today, everybody is envious of his enormous sums of cash. It was similar in 2008. In the year of the credit crisis, when even creditworthy companies literally begged for every dollar, Buffett was the only one who had a large sum of cash at his disposal. During 2008, he invested USD 48 billion, half of it during a single week at the nadir of the crisis in October. These acquisitions brought the Berkshire shareholders great profits in subsequent years. I think that now history is going to repeat itself. Buffett is again the only one who has big money to spare and prices are very attractive. For sure he is both actively buying back Berkshire shares and buying shares of other companies even as his telephone is ringing with offerings of big transactions. I am very glad that one-sixth of our portfolio is invested right there.

Berkshire stock has a singular combination of expected return and risk. Berkshire Hathaway’s business risk is by far the lowest among all large publicly traded companies, and its business model is much more resilient than are those of other companies. In other words, Berkshire will continue to prosper also in times when today’s stock market leaders will no longer be its leaders. Berkshire Hathaway is one of the most amazing stock market stories in history. It is a story that will continue long into the future, and Vltava Fund is a part of it.

Credit Acceptance also benefited from the financial crisis in the years 2008–2009. Just take a look into its annual report to see the unbelievable growth in the company’s earnings in those days. This is because its business model is different from those of its competitors, and this gives it a chance to make the most of periods when others have financing difficulties. This might be right about now.

As an insurance company, Markel stands somewhat apart from the current crisis. It has its own life and cycle, and one of the key indicators is the amount of capital in the sector as a whole. Because this will be less available now, insurance rates will have a tendency to rise and those insurance companies having enough capital will benefit from it. Markel is among them. It has large capital at its disposal and great capacity to increase the volume of premiums written, which currently make up only 45% of its owners’ equity annually. That Markel is launching an offensive is also demonstrated by the fact that two weeks ago, when stock prices were already dropping, it closed another one of its acquisitions.

The second group is made up of companies where we expect limited impact. Here are the companies Alimentation Couche-Tard, Babcock International, Teekay LNG Partners and LabCorp. These together make up 23% of the portfolio. Like Markel, the Canadian Alimentation Couche-Tard also is on the offensive. At the moment, it is negotiating to acquire the Australian company Caltex and low prices are playing into its hand.

Babcock is a British company whose main client is the British government. Some military programmes or programmes involving nuclear energy are planned decades in advance and continue on their normal course. Moreover, the British government always pays its invoices.

We have already mentioned Teekay and will come to LabCorp below.

The third group consists of companies where we expect negative, though not too considerable, impact. These are Samsung, Sberbank and Crest Nicholson. Samsung is the global leader in all four sectors of its business operations. Its main business, which is in semiconductors and memory devices, is presently in the expansion phase of its cycle. Other sectors will go through recession, but the company’s position will remain at least as strong as it has been to date.

In Sberbank, we have a precedent from about five years ago. When Russia attacked Ukraine, the entire country was caught in recession, was under sanctions, and at the same time oil prices and the rouble’s exchange rate collapsed while interest rates went over 15%. Even in this environment Sberbank remained profitable in every individual quarter. Its return on equity exceeded 10% in the worst year, 2015. The majority of European or Japanese banks would have given anything for this even in times of economic prosperity. The current recession will be milder in Russia, and impacts on Sberbank’s financial results should be much smaller.

Crest Nicholson is a company that builds family houses in Britain. At the moment, operations are suspended across the whole sector due to the virus quarantine in the country. Thereafter, it should return to its usual operations.

The final group is made up of companies that will be hit harder by the recession. These companies are BMW, Magna and WH Smith, and they comprise 19% of the portfolio.

Most car manufacturers have part of their factories temporarily closed. This applies also to BMW, which has 40% of its production in standstill. Magna, as a supplier to all the big car manufacturers, is in a similar situation. Its production is running at only half throttle. The sector as a whole, however, should return to production after the epidemic will be over, as is happening in China now. For this year, however, we expect a worldwide decrease in car sales of about 10%. Among all car manufacturers, BMW and Toyota are the strongest financially and among the big suppliers the strongest may in fact be Magna.

WH Smith is probably the company most affected within our portfolio. Airport shops account for 27% of its sales. Moreover, some of its city shops in Britain are closed due to quarantine. Thus, from a profitability point of view, this year can basically be written off. The company’s long-term ability to earn high returns on capital probably will not change in the future.

People generally tend to overestimate the importance of current events compared to past ones. From the human and economic viewpoint, the coronavirus epidemic and ensuing recession are wholly unpleasant. WH Smith was founded in 1792, however, and, when we think about it, since that time the company itself and humankind as a whole must have gotten through more difficult trials than the one we are going through now.

To sum this all up, the companies we hold are very profitable in the long term, financially strong and self-sufficient. They do not need to rely on the market for external financing, and their businesses are not in those sectors most crippled by the recession and virus. Our long-term resistance to buying companies that are financially weak, unprofitable and relying on the willingness of the market to finance them at any time is now proving its worth. In situations when stock markets lose 40% of their market value in a month, everything falls, including financially strong companies. This cannot be avoided. From a medium-term point of view, it is likely that their businesses will get back on track and it is also possible that some of them will even benefit from the recession. Crucial will be the ability of individual companies to adapt to changes that life brings. We are in touch with the managements of our companies and follow their developments very carefully. If necessary, we will react instantly.

LabCorp

I could easily devote the next part of this letter to demonstrating that our shares are undervalued and show this for one after another. I think that would be of little use, though, because that is clear at first view. Let me show at least one example representative for all.

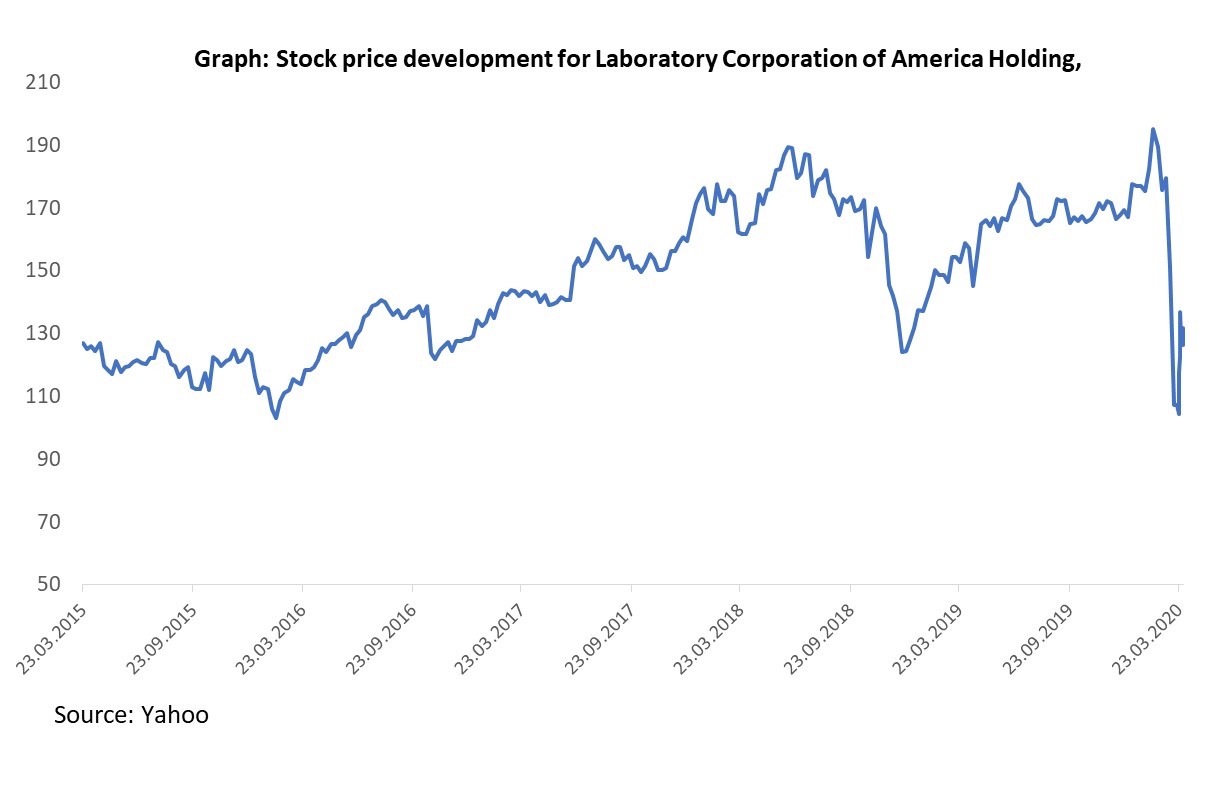

LabCorp is a company owning the largest network of medical laboratories in the United States. Moreover, it provides testing of new medicines for pharmaceutical companies. That means it is a business that is not likely to be handicapped over the long term by recession. Temporarily maybe, yes, because people will put off some of their preventive examinations and there will be fewer samples taken for testing for some time. Otherwise, though, we cannot expect that people would suddenly stop taking care of their health or that they all of a sudden would stop having diseases. By the way, LabCorp is testing about 500,000 samples a day and runs about 5,000 different tests, including for the coronavirus.

Moreover, it is possible that LabCorp will benefit from the recession due to the fact that consolidation in the sector will accelerate. Some weaker laboratory chains or small laboratories belonging to local medical practices will probably disappear during the recession or will be bought out by bigger players. LabCorp’s market share probably will be greater in a couple years than it is today.

LabCorp is a stable, noncyclical business that is minimally affected by recession. Nevertheless, its stock price recorded a 45% drop last month.

This has little to do with the real value of the company, however. If it did, that essentially would mean that investors think LabCorp’s profits will decrease by about half forever. That is not very likely.

Although LabCorp shares were not expensive prior to this drop, at its end they were trading at a very low P/E of 9. This situation will not last forever. As soon as the situation in the markets calms down and investors once again start to look at the fundamentals of individual companies, the stock prices will again begin to reflect those fundamentals. For the price of LabCorp shares to return to customary values, it would need to grow by 80% from the March low. These are the kind of potential gains we are considering today in looking at some stock prices. LabCorp is far from being something special in this sense. It is rather a middling-attractive stock.

Changes in the portfolio

During the two years 2018–2019, we bought only two new stocks. Last month, we bought four. I intentionally do not mention them in the previous text, because these positions are smaller so far and we intend still to build them up. By their quality and resilience they fit well into our portfolio. All are in the USA. We have owned two of these stocks previously and we know them well. The third one is very new and the fourth is a special opportunity where we expect a shorter holding period. We have been pointing out for some time already that the fact most money is managed by passive or covertly passive funds will mean that as soon as investors start to withdraw more money from these funds, the funds will have difficulties to find enough buyers. This is exactly what happened in March. Especially ETFs had big problems with this. That is because their promised liquidity is much higher than is the liquidity of the assets they hold. They had no choice other than to sell out their positions at nearly any price. This created attractive opportunities, and we took advantage of one of these. It provides a beautiful example of how easily wealth can shift from passive to active investors. If the proportion of passively invested money will continue to grow, these opportunities will appear with ever increasing frequency.

What happens now?

In a recent interview with CNBC, Bill Miller, one of the most successful and experienced investors, stated: “There have been four great buying opportunities in my adult lifetime. The first was in 1973 and ‘74, the second was in 1982, the third was in 1987, and the fourth was in 2008 and 2009. And this is the fifth one.”

My personal experience is shorter and begins no earlier than in 1993. I have experienced many crises. The first one was immediately in 1994, then the Mexican one in 1995, the Asian one in 1997, the Russian crisis in 1998, the dot.com crash in 2000, and so on. In my opinion, in all those 27 years there was only one time in the markets when there were more undervalued investments and in larger amounts than this year at the end of March, and that was at the beginning of 2009.

It is to be expected that negative news from the economy and individual companies will continue to appear for some time, and the news may be much worse than what we have seen to date. In similar situations, however, markets usually turn around much earlier than the point at which the news changes from negative to positive.

An advantage of stock markets is that sometimes they drop and allow for making the most of very attractive prices. Other classes of assets do not offer this, and neither do other forms of ownership. Whereas investors in real estate or in private equity funds, for example, due to the practically zero liquidity of their investments, will just watch from the sidelines how much their prices drop and wonder whether the debt with which they work will drown them, in stocks it is possible to react straight away.

Each year we analyse several hundred companies, and when there comes a stock market decline we need not lose time looking for opportunities. We know what to buy and we can act straight away. That is exactly what we are doing. We do not try to predict when the market will bottom out. That is neither possible nor important. We endeavour to take advantage of the investment opportunities at hand. If history is any kind of guide in the markets, it is likely that at some time point when we look back we scarcely will believe the prices at which it was possible to buy some stocks today. I have exactly the same feelings when I look at stock prices from the end of 2008. Returns in subsequent years corresponded to this, too.

We are well aware of the possibility that we can make mistakes in our considerations. We always are conscious of this, and we strive to remain humble in relation to the events around us. Our strategy is not cut in stone. We endeavour to evaluate our own investments. We monitor which things work and which do not, and we try to differentiate what part of that can be attributed to chance and what part to our own decisions. On the other hand, we are not paralysed by fear and the uncertain future. The future is always uncertain, and that is a good thing.

Warren Buffett said in a recent interview with CNBC that coronavirus should not influence how investors invest into stocks. I do not agree blindly with everything Buffet says, but I definitely agree with this statement. The main reason stocks have higher returns over the long term than any other class of assets is that they represent partial ownership in companies wherein people create value through their work. This scarcely is going to change in future.

Daniel Gladiš, April 2020

For more information

Visit www.vltavafund.com

Write to investor@vltavafund.com

Follow www.facebook.com/vltavafund