3/2020 Techno party

Open pdfTECHNO PARTY

In several recent conversations and debates I have encountered the question as to whether today’s developments on the American market resemble those of 1999. Whenever this topic comes up, I always discover there to be relatively few investors having had experience with markets at the end of the past millennium. For a person to be able to assess the madness that occurred on markets in 1999 one would have to have been an active investor at least since the mid-1990s in order also to have experienced the gradual swelling of the speculative bubble of those times. One would also have to still be an investor today to be able to compare the two periods. This considerably narrows the field to continuously active investors over 50 years of age. I sometimes ask myself whether this is not in fact the crux of the problem with markets at present. There are relatively few investors with this experience today. I know I’ve already told this story somewhere recently, but I would like to repeat it here, because it keeps coming back into my mind.

At the start of this year, still before the pandemic, I was attending an investment conference. One of the investors there was boasting about his recent results and declared that while Buffett is a “nice old man” he no longer understands markets much and should go into retirement. In the ensuing discussion, it came to light that this investor has been active in the markets since 2009, just a little over 10 years.

What this means, however, is that, given such a short time, he essentially has experienced almost nothing of markets. He knows only one environment, and that is one of declining and low interest rates, negligible inflation, dominance of passive investing, and considerable outperformance of a small circle of large American companies. He has never experienced, for example, rising interest rates, high inflation, the American market lagging behind the rest of the world, a change in currency regimes, significant tax increases, a rush of investors from passive to active funds, high commodity prices, prices of zombie companies plummeting to zero, a collapse in the valuations of high-quality, profitable companies, a credit crunch when financing is no longer available even to firms with solid investment ratings, markets that are long trading below their average historic valuations, an extended period when growth stocks lag behind value stocks, a massive wave of bankruptcies and uncovered swindles, larger armed conflicts, or the expropriation of gold, among other things.

Buffett started investing in 1941, just before the attack on Pearl Harbor. That means he has experienced all the above – and some of these even repeatedly. He is no superhuman. Sometimes he makes mistakes, just as Einstein, Newton, and Mendel made mistakes. But it is difficult to imagine that his 79 years of patiently accumulated experience could represent anything other than a huge advantage over younger investors. It is perhaps precisely because of this experience that Buffett is capable to put current developments into historical perspective and compare them much better than anyone else. And it is rather unlikely that as an investor he would have gotten worse with time. I think part of the problem with markets today truly lies in the fact that most investors do not realise that they have relatively little experience and that the experience they do have has been acquired during a very specific time. As Harry Callahan says: “Man’s got to know his limitations.”

1999 and 2020

I see several striking parallels between today and 1999. The main ones are the massive speculation among small investors, concentration of the largest companies in the indices, a predominance of passive investing, justification being made for exorbitant prices of certain stocks accompanied by often laughable arguments for currently ignoring most other companies, overall expensiveness of the market, and the frequent talk that fundamentals (in other words, prices) do not matter. I will address these phenomena, at least in a somewhat simplified way, because together they indicate what further developments will look like as well as how investors can successfully navigate them.

Speculation among small investors

An unbelievable speculative mania began to take off among small investors at the end of the 1990s. Almost everyone with an IQ greater than the day’s calendar date started trading stocks. People often abandoned their jobs and in droves started “day trading”, because they believed it to be the one way to make a lot of money fast, safely, and without working. They saw the stock market as a “risk-free money machine” and often even borrowed money to fund their speculations. For obvious reasons, those speculations were directed primarily at the most popular and therefore most expensive stocks. Thereby, of course, they pumped up their price bubbles even further.

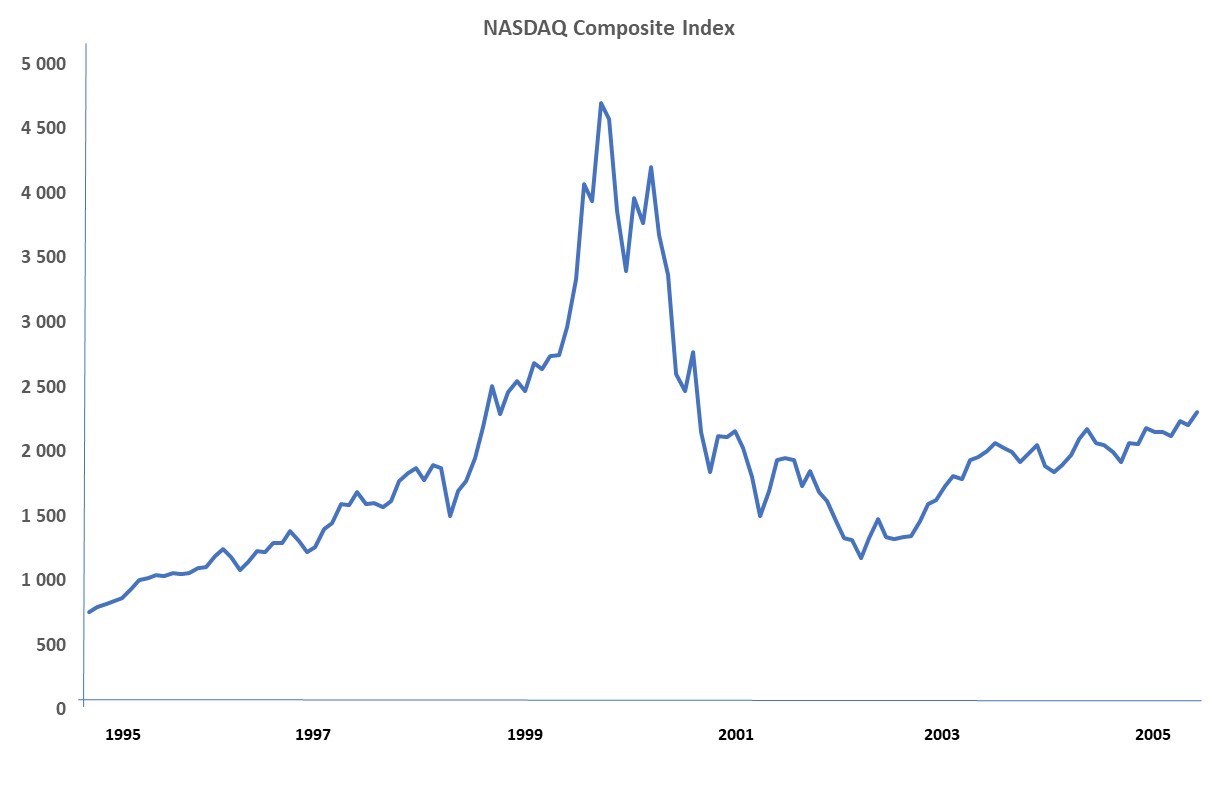

The media fed the mania with stories about people who made a lot of money quickly. That was bound to happen, of course, because when a lot of people undertake risky gambles there must always be a winner. After all, each week someone wins the lottery. But there was no happy ending. The Nasdaq, which was the main measure of the speculative mania, rose by some 400% between 1995 and March of 2000, then fell 78% by October 2002. Many speculators lost everything; if they were lucky, they got their old jobs back.

Today, I feel a sense of déjà vu. People thrown into quarantine in the spring suddenly had a lot of free time, fewer opportunities to spend their money, and, thanks to government subsidies, paradoxically, often higher incomes. Casinos were closed and sport betting also was not possible, so the only game in town was the stock market. They entered the market with the same gusto as did their predecessors 20 years earlier. The first outcome is the same as it was then: massive price growth in popular stocks whose prices often already had long been unjustifiable by any rational valuation. I fear that the end of this mania will be similar to that after 2000.

Passive investing and concentration of large titles

One of the dominant trends in today’s markets is the enormous prevalence of passive investing. According to a Bank of America analysis, approximately 50% of all stock investments in the USA in 2019 were made passively, which is to say primarily through index funds and ETFs. This trend strengthened still more significantly this year, and it is now quite possible that up to 60% of money is invested passively today. It would seem that 40% actively managed money is still sufficient to ensure satisfactory functioning of price formation and market efficiency. When I think, however, about the fact that the founders of the largest companies still retain large proportions of the shares (in Amazon, Facebook, Alphabet, etc.) and that these shares are therefore not in the market, I realise that the so-called free float in these companies can often realistically be only around 25%. That is awfully low. Any further influx of money into passive funds would automatically mean further purchases of shares from this limited pool. If we take into account the fact that for passive funds the purchase price of shares is not an issue, it is no surprise that the current absolute predominance of passive investors on the market has resulted in sharp growth in the prices of those same companies. The top five (Apple, Microsoft, Amazon, Alphabet, and Facebook) today account for a quarter of the S&P 500 index. Such high concentration among the largest companies in this index has never occurred before. The growth in stock prices of this big five has in turn pulled up the whole index. This unavoidably means that most active investors are lagging behind the index, because either they have already sold these expensive shares or they hold proportionately many fewer of them than there are in the index.

What does a look at history tell us about this development? First of all, we should realise that the tug-of-war between active and passive investors over greater share of the market is nothing new. This battle has been going on for decades already and is essentially cyclical. At times one group is on top, then the other. At the moment, it is passive investors who are ahead.

When I was still working as a broker in the mid-1990s, among my American institutional clients and on the markets in general there was an altogether clear opinion that only a fool would buy the indices, because active selection of stocks could easily beat an index. And most active funds at that time truly did. That situation reversed itself at the end of the 1990s, when the predominant opinion became that it made no sense to select individual stocks when you could simply buy the Nasdaq index, which continued shooting up. The subsequent collapse of the Nasdaq by 78% chastened enthusiasts for this trend, and then, until 2010, the predominant opinion was that it is better to select individual stocks than to cling to indices. In the past 10 years, passive investing has once again come to dominate. It would be very unwise to think that the long-standing cyclicality of this development has ended and that passive investing will now prevail forever.

I am a little bit afraid about what will happen with the main indices, and especially their largest components, once investors start, for whatever reason, to turn their backs on passive investing. There simply is not anyone in the market who could absorb the selling from these funds. Active investors’ portfolio capacity is very small. If they comprise only a quarter to a third of the market and hold on average roughly 5% of their portfolios in cash, then they simply could not contain a sell-off tsunami that passive funds might dump on the market. Moreover, they would not even be willing to do so. And if passive funds do not care how much they pay for individual shares, then they also will not care how much they sell them for.

Relative returns of actively managed funds

Just as the shifting of money between active and passive funds has a cyclical nature, so, too, does the relative performance of actively managed funds as compared to the main indices. Actively managed funds tend to lag significantly behind markets at times when the trend of passive investing is near its peak and to outperform markets at times when investors turn away from passive investing. There is a simple explanation for this. If an actively managed fund were today to outperform an index more than a quarter of which consists of just five companies, then not only must it hold shares in all of them but also have essentially relatively more of those shares than are in the index. The result would be a highly concentrated and very expensive portfolio. Most active fund managers realise that to pursue the index at any cost would require taking on ever greater risk. This certainly is not something their clients expect of them, and so sooner or later most of the active managers will decide to stay away from the speculative mania. So it is today, and so it was in 1999. And when the tide goes out, in most cases their strategy will be rewarded by good returns. Actively managed funds outperformed the main indices through most of the first decade of this century, in the mid-1990s, at the start of the 1980s and the 1970s. I believe another such period is coming.

Justifying stock prices with laughable arguments

I am now old enough to remember a time when it was said that a company with a website had a huge competitive advantage. People really seriously believed that, and even though it of course sounds rather stupid today, it is relatively harmless compared to some other such examples. As the technology bubble gradually grew in certain stock segments during the second half of the 1990s, investors needed to justify ever higher and higher prices. They demonstrated unbelievable creativity in doing so. By definition, it can be said that the value of any investment is equal to the present value of its future cash flows. What to do, however, if cash flows are negative over the long term? Should we try some other high multiples, perhaps by using some distorted EBITDA value? If that is not enough, we could try some crazy price/sales multiple, since sales is the only positive number in the whole profit and loss statement. But what if the company has scarcely any sales? Then one must turn to one of several new metrics like website clicks, number of eyeballs that have seen the website, or some form of so-called “total addressable market”, which is typically an entirely irrelevant number whose sole advantage is that it is really high. And then one multiplies it by some large multiple and thereby reaches the desired target price for the share. The higher, the better. The higher the target price, the better the analyst’s supposed visionary powers.

Anyone who had not lived through this would struggle to understand the madness people went through at that time to justify some stock prices. Today we are on the same track. Some “analyses” and arguments presented today are even more creative. In some cases, I cannot help but to laugh. But it really is not all that funny when I realise that these analyses are an affront to the very word “analysis”, that they discredit the entire analytical field, and especially that they will bring massive losses among investors who follow such advice. Once the final arguments for justifying certain astronomical prices have run out, it will be again declared that fundamentals do not matter at all, because prices continue to rise all the same. This specific and naïve argument has emerged again and again through the decades and tends to be a very good contrarian indicator. We hear it today at every turn. The market has a whole range of such artificially inflated stocks whose prices must fall by 80% before we can have a sensible discussion as to whether their prices are appropriate. They are concentrated in several small parts of the market, as was the case 20 years ago. Welcome to Techno Party 2.

Three segments of the current market

I would divide the entire market into three segments. The first is comprised of those companies with the highest market capitalisations. Firms like Apple, Microsoft, Amazon, and Alphabet are, in all respects, excellent businesses. They are highly profitable and have strong balance sheets. The sole problem is that their stocks are expensive for the reasons described above. It is precisely their high share prices that give these otherwise quality stocks their great riskiness. The argument that they are good companies just is not enough. High-quality and profitable companies (Microsoft, Cisco, Intel, Oracle, and Qualcomm) also occupied the upper ranks of the Nasdaq index at the start of 2000. Two years later, their stock prices were 34%, 78%, 49%, 55%, and 76% lower, respectively. Simply put, price is always important. The so-called Nifty Fifty stocks offer the same history lesson. In the 1960s and 1970s, these were regarded as stocks which you should acquire and hold onto almost regardless of their prices. Their subsequent collapse was a great disappointment for investors. Today we hear similar arguments, and therefore I am rather cautious about investing into the largest companies. Investors attracted to these largest companies should perhaps also consider the fact that of the ten largest companies in the S&P 500 index in 1999 only Microsoft is still in the top 10 today.

As for the second market segment, I would avoid it all together. This segment is most impacted by the current speculative mania. Twenty years ago, this segment included stocks such as WorldCom, Sun Microsystems, Yahoo, Global Crossing, Nextel, and Level 3 Communications. The best of them at the time, Sun Microsystems, had fallen 82% two years later. The others fared even worse. Many of today’s market favourites will very likely end up the same. Their list would be very long. For the most part, these are younger firms doing business in certain “sexy” sectors. As a rule, they are in deep losses. For some (e.g., Nikola or Tesla), investors even have doubts for various reasons about the legality of their businesses. There are quite a few companies in this segment that are successful in creating an illusion of an attractive business with great potential. They may succeed for a while, but once the market sees through it, the end comes quickly. Just look at examples of companies like Theranos, Wirecard or WeWork. The former supposed visionaries at their helm are now pariahs. Fake it till you make it.

Most speculators who own these stocks are not at all concerned about their fundamentals. They simply say that prices do not matter. But, as 1999 has shown, the biggest mistake regarding these companies was the overblown optimism about their long-term potential and simultaneous underestimation of the competitive forces. This market segment is extremely risky today, and there is a genuine danger that in many cases investors will lose everything.

The third segment, which is the largest in terms of number of companies, comprises the rest of the market. These are companies that the speculative mania has avoided, whose returns in recent years have substantially lagged behind the main indices, and which on the whole appear to be relatively cheap. Among them are a number of companies that we would not invest into under any circumstances, but there are also many high-quality, strong and profitable firms worth considering. We regard the combination of potential future expected returns vs. associated risks presented by these stocks to be much better than in the first two market segments. The longer these shares remain neglected, the more attractive investments they become.

What will come next?

When I compare the developments of today with those of 20 years ago, I am aware that things are never exactly the same and it is always possible to find arguments why these two periods are not wholly comparable. At the same time, I think it would be a mistake to ignore the lessons of history, especially when so many parallels that might point to future developments are evident. What happened after 1999 was not very pleasant for many investors. The bubble burst in March of 2000, and in the following two years the Nasdaq fell by more than three-quarters and the S&P 500 by almost half. Not even the largest, best-quality, and most-profitable companies – those similar to the ones in today’s first segment – avoided collapse. A great number of companies in the second segment experienced share price drops of more than 90%, and many went bankrupt. Overall, the third segment fared relatively well. Active managers who avoided the most speculative stocks performed very well during the subsequent market decline in 2000–2002, and active managers outperformed indices for almost the whole following decade. I think that American markets are once again facing something similar. Our entire portfolio is compiled with respect to this expectation.

All investors are influenced by the current market mania. It might be tempting to join in, and it would be very easy to do so. This requires no hard work or thinking. Simply acquire the most popular titles, hide among the crowd, and hope that a greater fool will buy them at a higher price before it all blows up. It is much more difficult to hold back, to analyse each investment opportunity conservatively, to consider the investment risk (a key component of which is the price), and to reject 99% of those stocks one analyses. We knew from the start that our decision not to be lured into speculation with the money you have entrusted to us would take time to bear fruit and that the returns would for a certain period be lower than those of the main indices. This time could easily seem endless to some and might lead some observers to conclude that we are incompetent, but that is just the way it is. Speaking for myself, I would much rather be criticised for investing cautiously and a reluctance to go along with the maddening crowd than to be labelled a gambler who tosses his clients’ money into risky and unjustifiable speculation. Such a thing is simply unimaginable for us.

It is impossible to gauge when the today’s main market trends will change. They may already have started to change a month ago, as indicated by decline in certain major titles during September. At the end of September, shares of Apple were 16%, Netflix 13%, Nvidia 8%, Facebook 14%, Amazon 11%, Alphabet 15% and Microsoft 9% lower than their recent all-time highs. Ate the same time, the whole market in September declined only by a modest 4%. Investors may have realized how expensive these stocks are. Or maybe it was just a temporary shudder and everything is still somewhere ahead. Specifically, a change in trends could cause an overall drop in the main American indices, a relative lagging of the first market segment behind the third, dramatic decline in share prices within the second segment, bigger awareness of the risks associated with passive investing, a much higher percentage of active investors outperforming indices, and perhaps even the American market lagging behind the rest of the world. In other words, stock markets would be entirely different from what we see today.

One might object here that our vision of future market developments is an example of wishful thinking because its fulfilment would be good for our stocks. Yes, it certainly would be. But the direction of causality is the reverse. Our portfolio does not shape our projections of future market developments. Rather, our projections about market developments shape our portfolio.

I would also be reluctant to give the impression that we are somehow a priori negatively biased towards technology stocks. Not at all. Since 2009, we have basically continuously owned some of them. These were Ebay, Oracle, Seagate, Apple, Microsoft, again Oracle, Hewlett Packard, IBM and Samsung. With the exception of IBM, where we lost about 6%, they were all very profitable. But there was a difference in buying Microsoft, for example, in 2010 with PE 10 compared to today, when it trades at PE of 35. At that time, the prevailing market opinion was that Microsoft no longer had anything to give the world and was gradually fading away, and we often had to defend our investment in Microsoft. Today, the prevailing view is that Microsoft will forever be one of the dominant companies in the world. Whether the current optimism and stock price is commensurate with future developments remains to be seen. In any case, the bar is set high enough. I think that we have studied and analysed at least 50 leading technology companies and we are also monitoring newcomers like Snowflake or Palantir. Once one of the ones we like is trading at an attractive price, nothing stands in the way of its inclusion in the portfolio.

Changes in the portfolio

During the past quarter, we acquired one new position, CVS Health Corporation. It is a relatively large American company with sales around the same level as Apple. CVS is a health care company. To put it simply, its business can be divided into three areas: a retail pharmacies chain, pharmacy benefit management services, and health insurance.

We have been following CVS for a long time. We began monitoring the company more closely in 2018, when CVS acquired the health insurance company Aetna, a direct competitor of Humana, into which we first invested in 2009. We like CVS’s new integrated business model, but, as tends to be the case with such a large acquisition, it often brings with it some problems. In most cases, acquisitions prove to be overpriced and come with large debt and integration issues. We decided to wait and see how things developed. Now, two years later, integration has not caused fundamental problems, the debt has been declining rather quickly, and the cost of the acquisition has long been reflected in the stock price. Today that price is around the same level as it was in 2013 and meanwhile the earnings per share have doubled. We acquired CVS at 7.5 times this year’s earnings and with a double-digit free cash flow return.

Looking back, we can say that the third quarter was notably less eventful than the first half of the year. The worst of the recession is clearly behind us, although its impacts will continue to affect markets and companies for some time to come. Some of the companies we hold are set to achieve their highest-ever profits this year. For others, the recession will negatively impact their profitability. Taken as a whole, I would say that our outlook for the companies in our portfolio is slightly more optimistic than it was three months ago and much more so than six months ago. For this reason, among others, through the summer we increased our positions in about half the stocks we hold. Today, our portfolio taken as whole trades at a P/E around 10. This is due in part to the fact that more than half the portfolio is invested outside the U.S. When people speak about the market, they often implicitly mean the American market. Let us not forget, however, that half of the total global market capitalisation is found in other countries. Non-American markets are not affected nearly as much by speculative mania as is the American market, nor is passive investing so widespread. These markets are also much less expensive. When we launched Vltava Fund in 2004, for many years the American indices had been significantly lagging the rest of the world, including both Europe and emerging markets. This could easily happen again.

Overall, I continue to think stock markets will gradually go much, much higher. The ideological revolution in fiscal and monetary policy which we witnessed this year, and especially the ongoing monetization of large budgetary deficits, may with time send the markets to high levels unimaginable today. They will move higher the faster governments and central banks succeed in their efforts to devalue currencies (see my previous letter entitled “The dam has broken”). Nothing has changed here. Markets will simply look a little different than what we have become accustomed to in recent years.

Conference invitation

In November, I will be organising together with Lenka Schánová the 7th annual Czech Investment Conference. You are all once again cordially invited! We look forward to meeting you on 9–10 November at Hotel Pyramids in Prague! The programme and registration are available at: www.ceskainvesticnikonference.cz

Daniel Gladiš, October 2020

For more information

Visit www.vltavafund.com

Write to us at investor@vltavafund.com

Follow us on www.facebook.com/vltavafund

and https://twitter.com/danielgladis